Dubai Islamic Bank Personal Loan Interest Rate

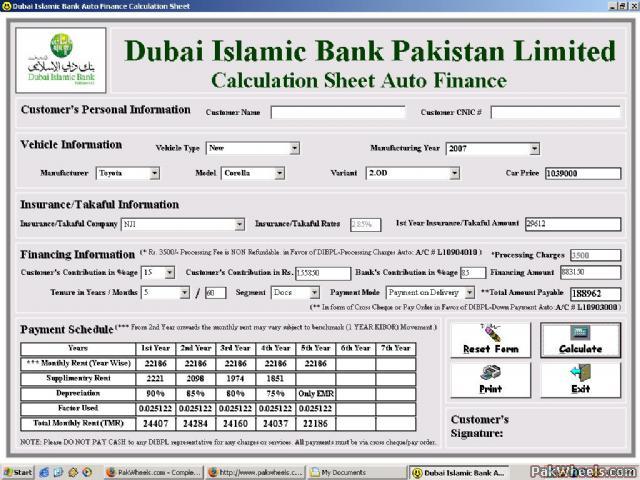

Flexible repayment tenure varying as per the finance option availed competitive interest rates.

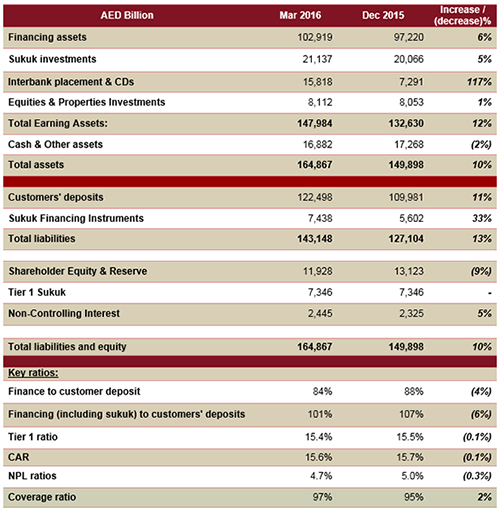

Dubai islamic bank personal loan interest rate. Minimum salary requirement is at the discretion of the bank. Maximum loan amount up to 20 times the monthly salary. Compare all uae banks for personal loans in dubai to find the best personal finance offers compare over 80 personal loans in the uae. A personal loan is money you borrow and pay back with low interest or high interest over multiple years.

From personal finances to credit cards and more we meet all your financial needs. The financing facility can be availed and utilized for financial needs such as education marriage medical expenses credit card loans settlements conventional loans settlements or meeting any other emergency needs in halal. Compare dubai islamic bank personal loan in uae min salary 3000 aed loan upto 4 million aed interest rate 6 onwards high benefits aed 1050 processing fee longer tenure apply for personal loan. 1 00 subject to max of aed 2500 high salary multiples competitive interest rates loan consolidation available free adcb credit card up to two times salary overdraft starting from 5 25 interest rate per annum.

Dib personal loan dubai islamic bank apply for dib salam finance personal loan online dib al islami personal finance dubai islamic bank with al islami personal finance from dubai islamic bank dib you can buy and acquire a variety of goods and services or get an upfront cash price. Quick approvals and minimum documentation. Starting from 6 25 interest rate per annum flexible eligibility criteria. However personal finance is a shari a compliant contract based product where the bank sells an asset at a profit as islamic banks are prohibited from charging interest.

Personal finance decisions are best made when they re simple stress free and focused on you. Competitive profit rates as low as 3 49. Use our personal loan calculator to find out your monthly repayment amount and apply for loans online get the lowest rate from emirates nbd adcb nbad hsbc dubai islamic bank and all major banks. Loan processing fee.

Finance for uae nationals and expatriates finance amounts of up to 20 salary multiples. Enjoy quick and easy access to funds with simple documentation high approval amounts and first installment in up to 120 days. Dibpl is the first islamic bank in pakistan to offer a shari a compliant personal finance facility based on the islamic finance concept of musawamah. So this product is riba free.

Features of sharjah islamic personal loan.